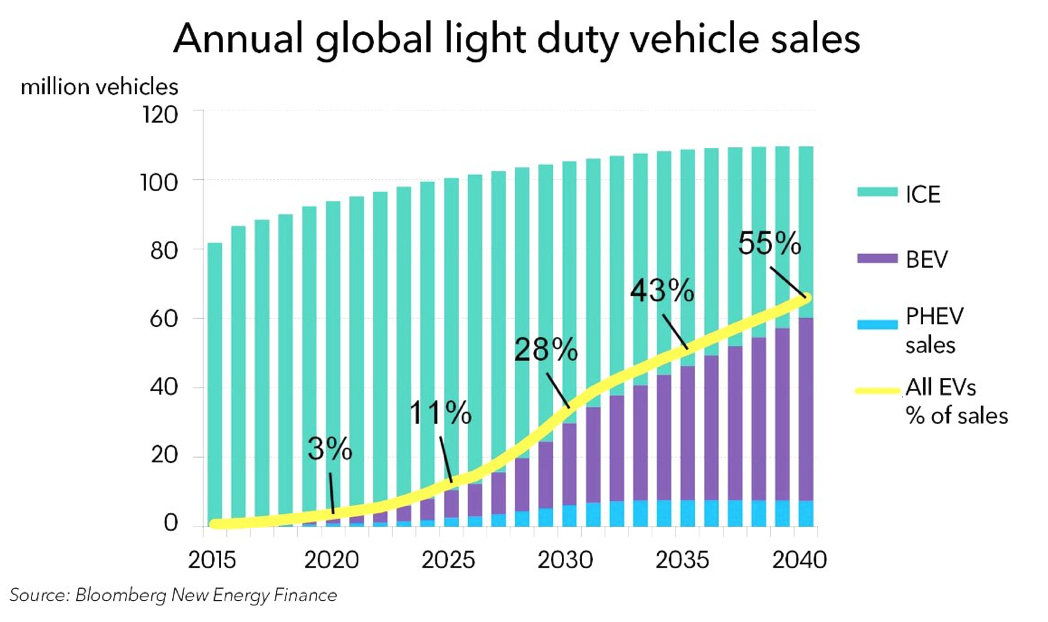

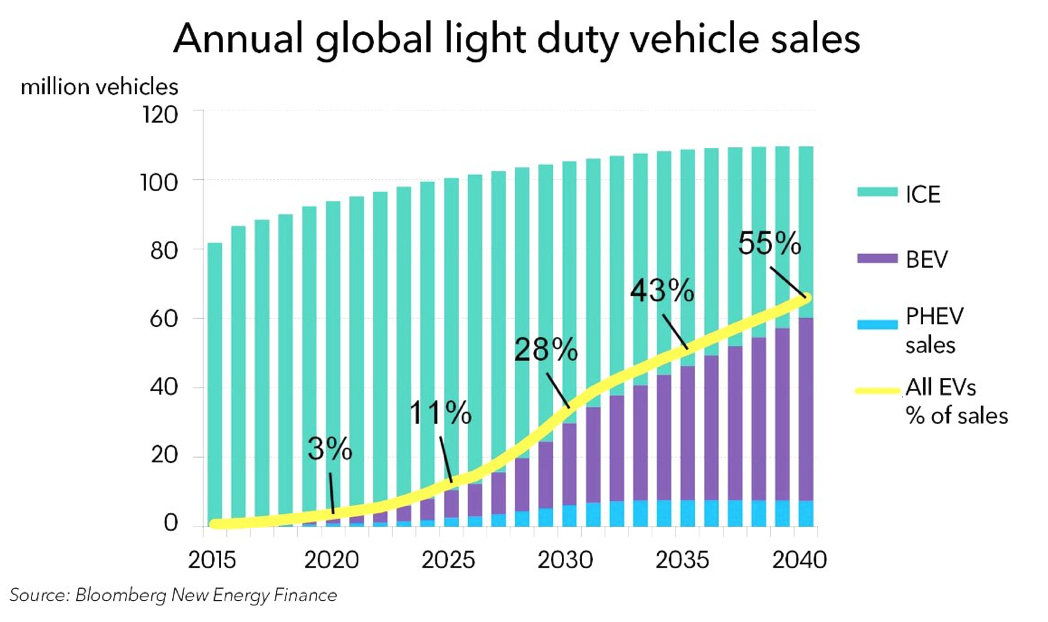

Yes, the electric vehicle came to stay. Growth in EV sales has been impressive in recent years. From 500,000 units manufactured in 2015 to 2.2 million in 2019. However, real growth is yet to come, and it will be a huge challenge for humanity, because it will require a change in the energy model that is necessary for the decarbonization of the planet.

Without any doubt, we are experiencing a shifting landscape, prompting many questions and challenges. Some of these relate to the technology itself, to the capacity of strategic sectors to support EV demand, and to business models that may emerge, in addition to many others. In this article we will try to respond to some of these questions, especially focusing on the European electric vehicle market.

Current picture and growth predictions

In 2019, global electric vehicle sales reached 2.2 million units. A total of 564 thousand of these units were sold in Europe. For 2020, before the COVID-19 crisis, the outlook for global growth stood at around 36%, with 3 million new unit deliveries. This trend was set to continue in 2021, with 4 million units (5% of all vehicles). Although COVID-19 has impacted the current sales, it has also proved how big is the impact of the fuel road transport to the overall pollution. Now more than ever we realize how important is to care our environment. The total electric vehicle stock was forecasted to be 13 million (9.2% penetration), and this trend will continue to rise for decades. This growth will be influenced by several factors, according to specialist firms and pacesetters in the sector. These factors include the speed at which charging infrastructures spread through key markets, such as China, which is currently – and will go on being – the world’s biggest EV market. Additionally, the development of electromobility will also depend on the transport sector, both in terms of goods and passengers. In the case of buses, the change is expected to be even quicker.

A new line of business emerges: EV charging equipment and services

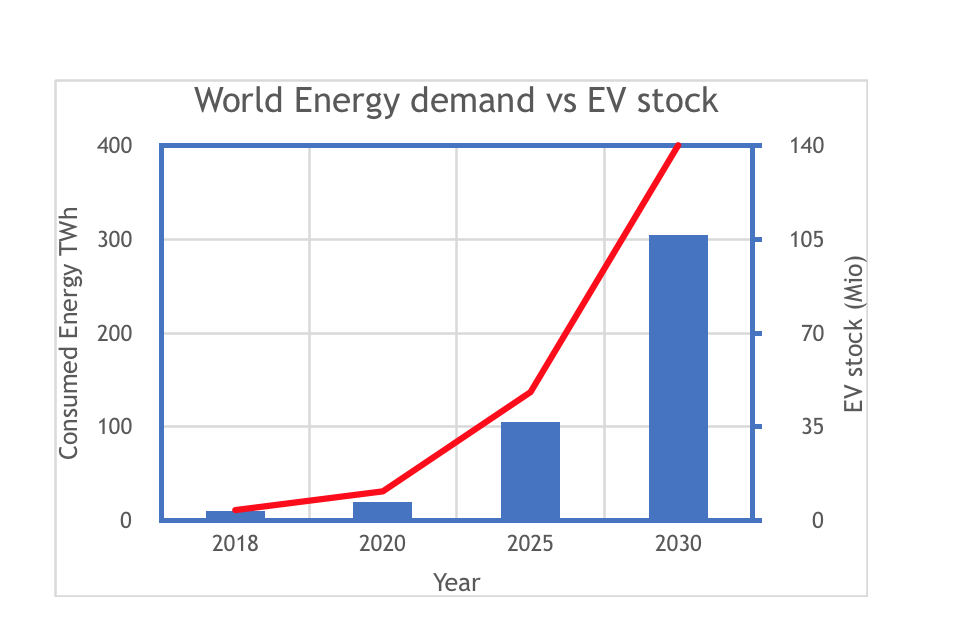

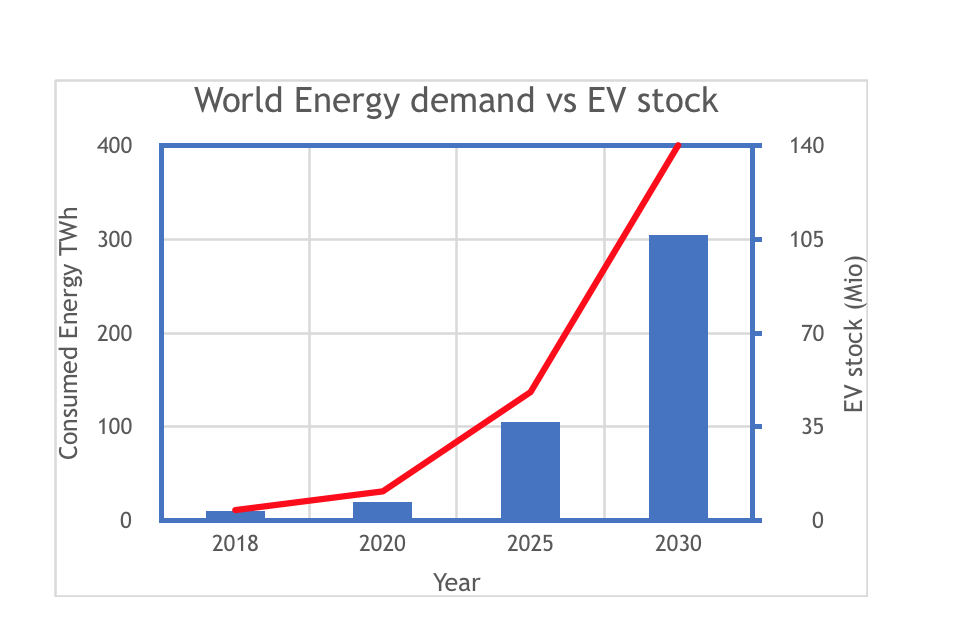

In 2018, the world’s total power consumption to charge the stock of 4 million EVs came in at around 10 TWh (12,500 km/year on average per car consuming 20 kWh/100 km). This figure is very low compared to the world’s total electric power consumption (25,000 TWh). In the EU it was 4,000 TWh, and in Spain 265 TWh.

The demand for power to charge EVs could reach 300 TWh in 2030 (to charge around 140 million EVs).

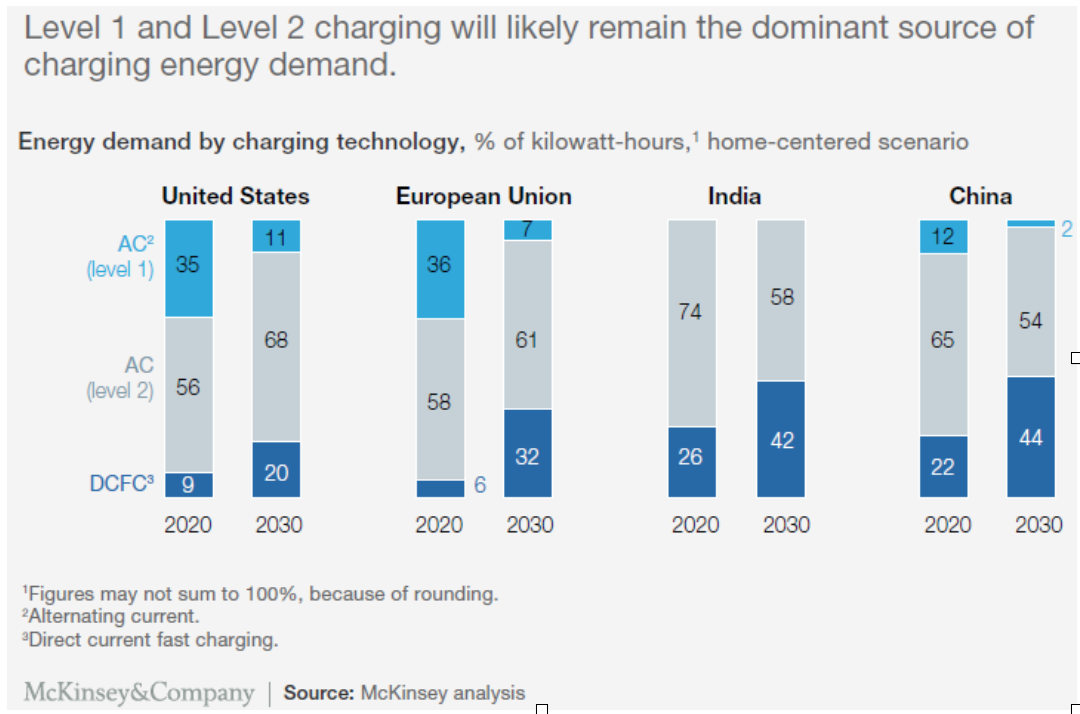

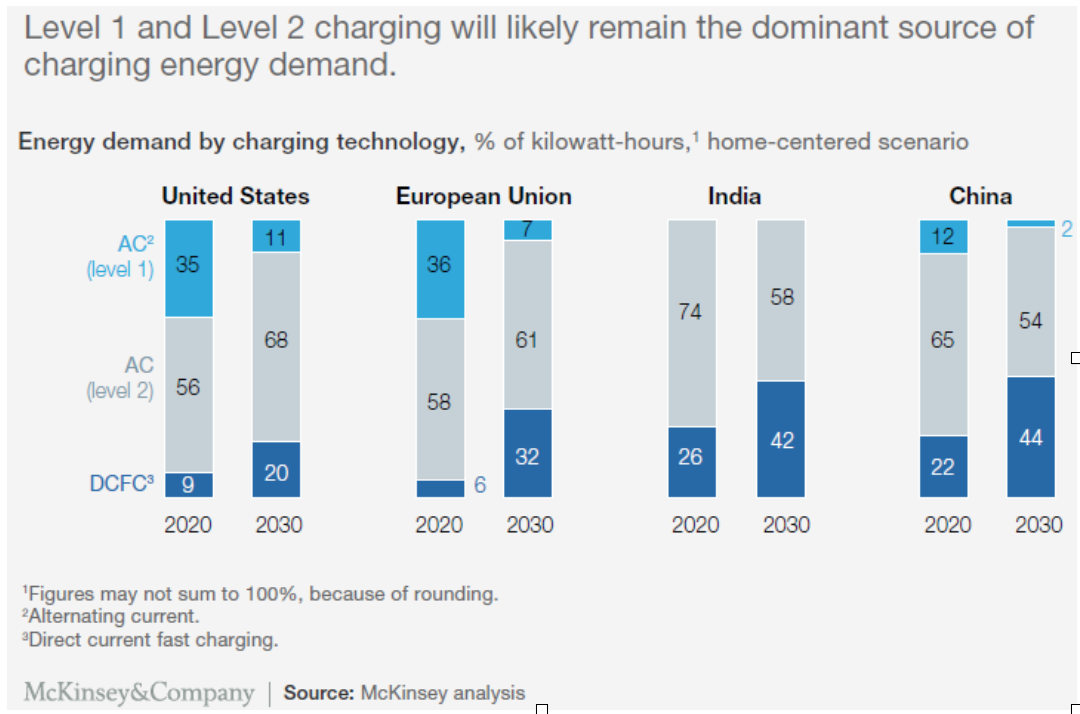

According to several predictions, alternating current (AC) will be the dominant source to charge EV batteries. However, direct current (DC) fast charging is necessary for drivers who do not have a charger at home and/or at the workplace, for vehicle fleets and taxis, as well as transiting vehicles traveling long distances (highways) and for electric buses (eBUS) and electric trucks (eTRUCK). As regards the latter, ultra-fast charging will be necessary.

According to several predictions, alternating current (AC) will be the dominant source to charge EV batteries. However, direct current (DC) fast charging is necessary for drivers who do not have a charger at home and/or at the workplace, for vehicle fleets and taxis, as well as transiting vehicles traveling long distances (highways) and for electric buses (eBUS) and electric trucks (eTRUCK). As regards the latter, ultra-fast charging will be necessary.

The power required to simultaneously charge 1 million EVs with an average output of 10 kW is 10 GW. Some will charge at home at 3.2–7.4 kW, others at work at 7.4–25 kW, some at public chargers 25–50 kW, and others at high-power chargers at 50–150 kW, etc. It is worth nothing that the million vehicles mentioned would charge around 35 GWh in their batteries (based on an average charge of 35 kWh per session). Therefore, simultaneously charging 1 million vehicles is only possible through smart management of the available power within the country, as well as regionally and locally (since it is necessary to take into account the day’s power curve and the local power distribution limitations).

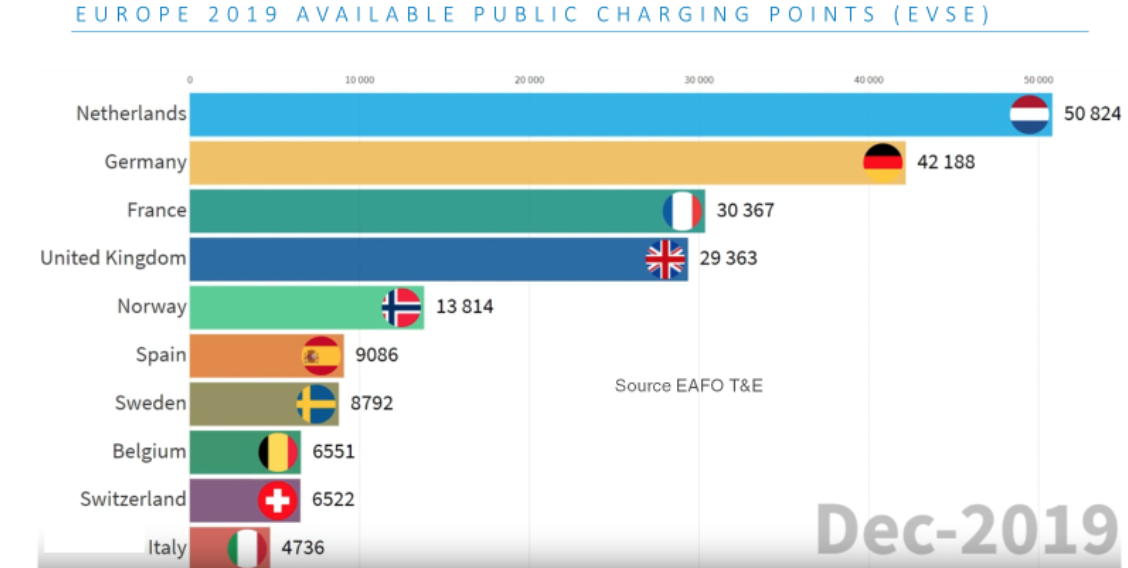

Mass deployment of EV charging points is key to the effective implementation of EVs. The sector of EV supply equipment (EVSE) manufacturers and solution providers must invest heavily. Meanwhile, the EV charging sector offers many opportunities for both small and large enterprises, which must also make big investments to reap the benefits.

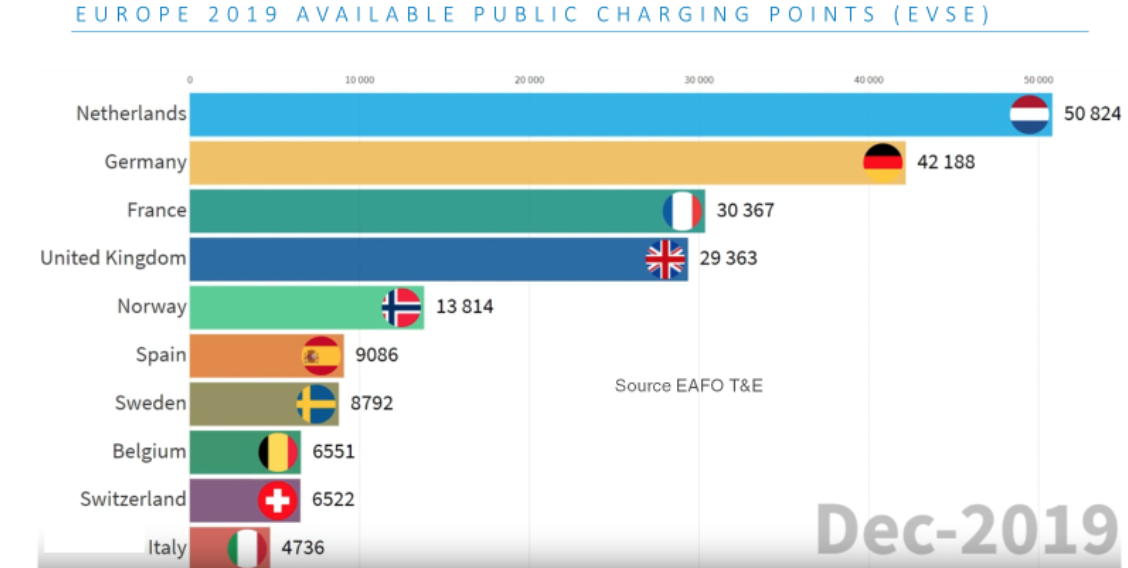

There are large gaps in terms of public charging among EU countries. As the Netherlands, Germany, France and the United Kingdom lead the supply of chargers accessible to the public, at the end of 2019 Spain had a little over nine thousand public charging points.

There are also differences in terms of costs. Depending on the country and operator, EV drivers can spend very diverse amounts when charging their EVs, ranging from free services subsidized by the government or local authorities, to highly disparate associated costs.

European picture, incentives and regulations

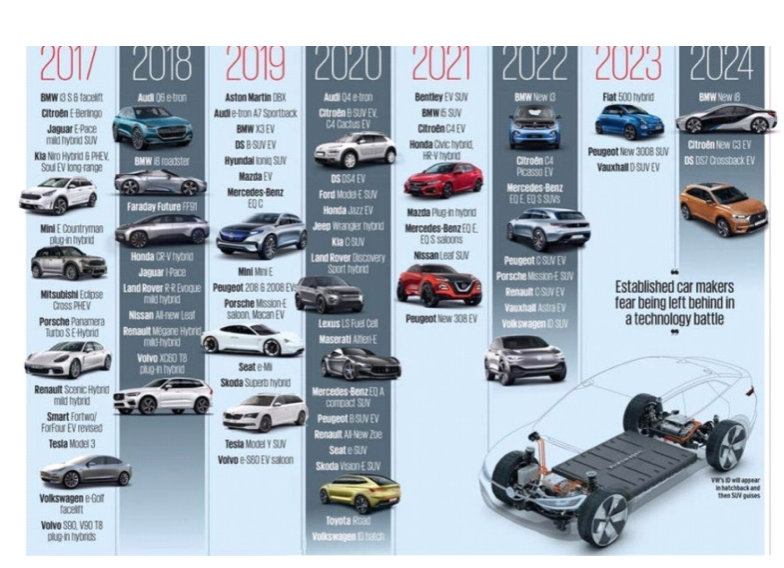

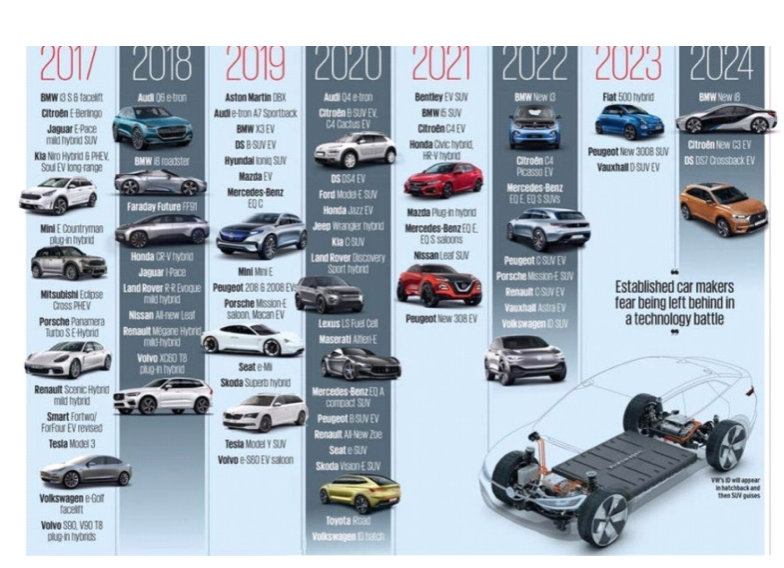

It can be said that indications chiefly suggest that the 20s will be the decade of electromobility. The European automotive industry has already started to put a plan into place along these lines. For instance, Volvo announced that all its vehicles will be electric or hybrid as of 2020. Volkswagen announced that in 2025, it would have 80 electrified models, Porsche stated that by 2023, 50% of its models would be electric, and Renault announced that in 2022, it would have 12 new pure electric models, in addition to many other examples.

In 2025, a total of 25 million electrified vehicles are expected to be manufactured in around 400 different models, 20% of which will be pure electric vehicles.

Meanwhile, there are currently many fast and ultra-fast charging projects in existence, like EV charging stations. The main shareholders and promoters of some of these are the automotive industry firms themselves.

In terms of regulations, there is European Directive 2014/94/EU published on October 22, 2014 on the deployment of alternative fuels urging Member States to implement charging points for electric vehicles (at least one station per 10 EVs). However, besides this directive, there is great divergence among regional – and even local – rules and regulations. This is also the case for subsidies and incentives.

Joan Hinojo

Circontrol’s General Manager

According to several predictions, alternating current (AC) will be the dominant source to charge EV batteries. However, direct current (DC) fast charging is necessary for drivers who do not have a charger at home and/or at the workplace, for vehicle fleets and taxis, as well as transiting vehicles traveling long distances (highways) and for electric buses (eBUS) and electric trucks (eTRUCK). As regards the latter, ultra-fast charging will be necessary.

According to several predictions, alternating current (AC) will be the dominant source to charge EV batteries. However, direct current (DC) fast charging is necessary for drivers who do not have a charger at home and/or at the workplace, for vehicle fleets and taxis, as well as transiting vehicles traveling long distances (highways) and for electric buses (eBUS) and electric trucks (eTRUCK). As regards the latter, ultra-fast charging will be necessary.